Remember when VISA was called “BankAmericard” and MasterCard was “Master Charge?”

Remember when VISA was called “BankAmericard” and MasterCard was “Master Charge?”

I remember when my dad brought his first credit card home. He told my mom, “Now you can put it on the Master Charge if you don’t have enough cash with you.” Such simple, innocent words.

I remember putting clothes on layaway in high school, using my weekly allowance and money from my waitressing job to pay down the balance. Remember layaway? The store kept the items until you could afford to pay for them. When the bill was paid, you got your stuff. My, my, how far we’ve come….

The consumer debt problem in this country is something I don’t have time to get into this morning, and I’m no financial analyst, but I got eyes. It’s going to get much worse before getting the tiniest bit better. And I’m not throwing stones at anyone, mind. Many of us are guilty of that impulsive credit card purchase; I’m the first to admit it.

But the trend is reversing, believe it. Could we soon see the days when retail commerce runs on a cash-only basis? I think the answer is, “sooner than you think.”

I read an article this morning with a quote from a woman in New Jersey who had just dissolved some personal debt. She said that “her family was only living according to their means and not spending anything extra.”

Imagine that.

Fink out.

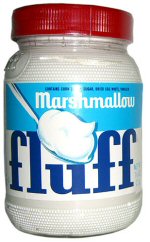

Well now, cats & kittens. Do we have a history with Fluff? I still love its marshmallowy yumminess. Fluffernutters were a staple of my lunchtime diet when I was a kid. What’s a Fluffernutter? Why, two slices of Wonder Bread, slathered generously with peanut butter on one and Fluff on the other, of course. Heaven. My mom made the best Fluffernutters. Just the right amount of innards. And love — don’t forget the love.

Well now, cats & kittens. Do we have a history with Fluff? I still love its marshmallowy yumminess. Fluffernutters were a staple of my lunchtime diet when I was a kid. What’s a Fluffernutter? Why, two slices of Wonder Bread, slathered generously with peanut butter on one and Fluff on the other, of course. Heaven. My mom made the best Fluffernutters. Just the right amount of innards. And love — don’t forget the love. But that’s not all there is to Fluffdom. There’s a whole Fluff universe out there that I did not know existed. Next year, you can attend the What the Fluff? Fluff Fest in Massachusetts, where all things Fluff really come together. From drinking a “Fluffachino” at the coffee shop (which really does sound yummy) to getting screened for diabetes (no lie), there’s tons of fun to be had.

But that’s not all there is to Fluffdom. There’s a whole Fluff universe out there that I did not know existed. Next year, you can attend the What the Fluff? Fluff Fest in Massachusetts, where all things Fluff really come together. From drinking a “Fluffachino” at the coffee shop (which really does sound yummy) to getting screened for diabetes (no lie), there’s tons of fun to be had. Congrats to Mandy R., who knew that the cute little propeller-headed character in yesterday’s contest was Quisp, spokesalien for the breakfast cereal from my childhood by the same name. She’s munchin’ on a huge Hershey chocolate bar ASAP.

Congrats to Mandy R., who knew that the cute little propeller-headed character in yesterday’s contest was Quisp, spokesalien for the breakfast cereal from my childhood by the same name. She’s munchin’ on a huge Hershey chocolate bar ASAP.